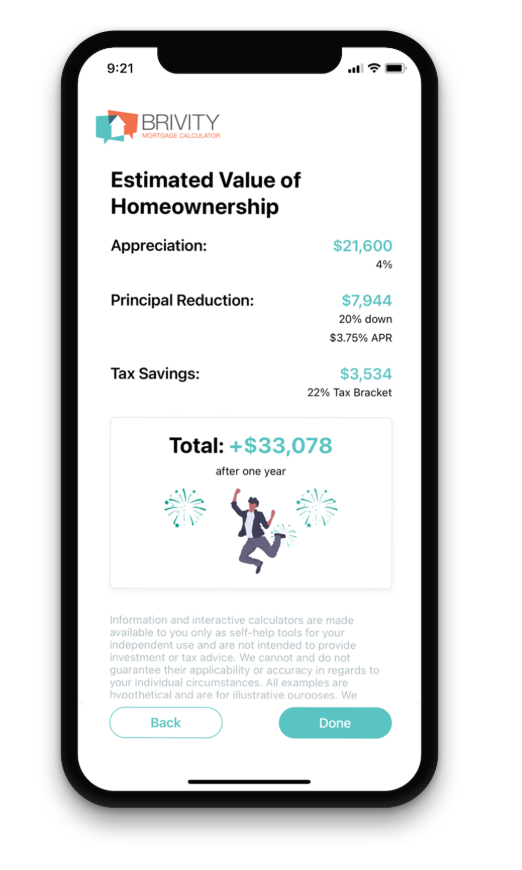

ESTIMATE YOUR MONTHLY PAYMENT

Estimate your mortgage payment, including the principal and interest, taxes, insurance, HOA, and Private Mortgage Insurance.

Find The Best Loan

Start The Process

At Anderson Realty Group, we're dedicated to helping you secure the best home financing options tailored to your individual needs. Our experienced real estate agents will guide you every step of the way, ensuring you make informed decisions that align with your financial goals. By connecting you with top local loan officers, we guarantee access to competitive rates and programs suited to your situation.

Take the first step towards your dream home by filling out our form to connect with a trusted preferred lender today. Contact us to learn more about your home financing options in North and South Carolina and embark on your journey with confidence.

Most Popular Home Loans

Here's a guide to the most popular home loans you can consider when purchasing in North & South Carolina. Our preferred lender partners can also provide information on other financing options that may fit your needs.

Whether you're a first-time homebuyer or an experienced investor, understanding the types of loans available can make your home buying journey smoother and more successful.

Conventional Loans

Conventional loans are mortgage options not insured by the federal government, typically offering competitive interest rates and flexible terms. These loans are ideal for buyers with good credit scores and the ability to make a sizable down payment.

FHA Loans

Backed by the Federal Housing Administration, FHA loans are designed to help first-time homebuyers and those with less-than-perfect credit. They offer lower down payment requirements, making homeownership more accessible.

FHA Reverse Mortgages |

VA Loans

Available exclusively to veterans, active-duty service members, and eligible family members, VA loans provide favorable terms and conditions, often requiring no down payment. This benefit is a testament to our nation's gratitude, offering military members an easier path to homeownership.

Fixed Rate Mortgages

Offering stability and predictability, fixed-rate mortgages maintain the same interest rate throughout the life of the loan. This option is ideal for buyers who plan to stay in their home long-term and prefer consistent monthly payments.

USDA Loans

USDA loans are geared towards buyers in designated rural areas and offer 100% financing with no down payment required. These loans are backed by the U.S. Department of Agriculture and are perfect for those seeking a home in less densely populated regions.

Jumbo Loans

For those looking at high-value properties, jumbo loans exceed the conventional loan limits set by the Federal Housing Finance Agency. These loans are suited for buyers who need to finance a luxury home or property in a high-cost area.

Adjustable-Rate Mortgages (ARMs)

Adjustable-Rate Mortgages (ARMs)

ARMs offer an initial period of fixed interest rates, after which the rates adjust periodically based on market conditions. These loans can be advantageous for buyers planning to move or refinance within a few years.

Bridge Loans

Bridge loans provide short-term financing to bridge the gap between buying a new home and selling your current one. This type of loan can be useful if you're navigating a transitional period between properties.

Communication

We will always keep you in the loop. Don't be afraid that you'll miss out on the important steps in the process.

Additional Loan Types

FHA Home Loans

201(K) Rehabilitation Loans

From start to finish, your real estate journey is going to be one that'll leave you happy and stress free.

FHA Reverse Mortgage

We keep up to date, so that you're up to date on everything there is to know about buying or selling a home.

Mobile & Factory Built Home Loans

We will always keep you in the loop. Don't be afraid that you'll miss out on the important steps in the process.

Powerful Search

Our Property Search is hands down, the best real estate search experience on the market.

Mobile Search

Search, save, and receive alerts on all of the properties you've visited, right on your mobile device.

Our Guarantee

We are here to go to work for you. Trust in our years of experience and our promise that your needs come first.